Articles

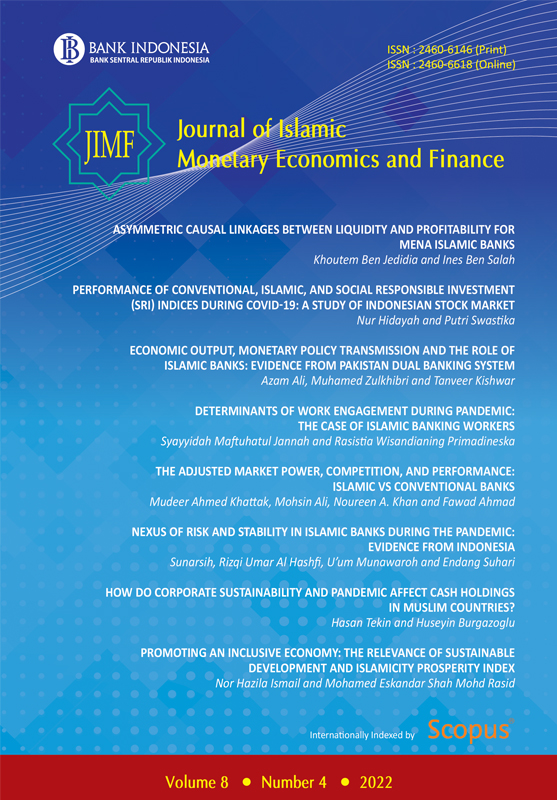

ASYMMETRIC CAUSAL LINKAGES BETWEEN LIQUIDITY AND PROFITABILITY FOR MENA ISLAMIC BANKS

Abstract : 1479

|

PDF : 1228

PERFORMANCE OF CONVENTIONAL, ISLAMIC, AND SOCIAL RESPONSIBLE INVESTMENT (SRI) INDICES DURING COVID-19: A STUDY OF INDONESIAN STOCK MARKET

Abstract : 2190

|

PDF : 1264

ECONOMIC OUTPUT, MONETARY POLICY TRANSMISSION AND THE ROLE OF ISLAMIC BANKS: EVIDENCE FROM PAKISTAN DUAL BANKING SYSTEM

Abstract : 1541

|

PDF : 1278

DETERMINANTS OF WORK ENGAGEMENT DURING PANDEMIC: THE CASE OF ISLAMIC BANKING WORKERS

Abstract : 1400

|

PDF : 1038

THE ADJUSTED MARKET POWER, COMPETITION, AND PERFORMANCE: ISLAMIC VS CONVENTIONAL BANKS

Abstract : 1666

|

PDF : 1238

NEXUS OF RISK AND STABILITY IN ISLAMIC BANKS DURING THE PANDEMIC: EVIDENCE FROM INDONESIA

Abstract : 1921

|

PDF : 1374

HOW DO CORPORATE SUSTAINABILITY AND PANDEMIC AFFECT CASH HOLDINGS IN MUSLIM COUNTRIES?

Abstract : 1711

|

PDF : 1333